Document Automation

Arion is the sole UK distributor for WallStreetdocs which is the only Document

Automation system on the market designed specifically for the Capital markets.

Banks, governments and companies routinely raise capital and/or hedge risk by issuing a broad range of securities. Many of these securities are extremely complex. Designing and documenting them places the highest demands on structurers, traders and lawyers alike. Accordingly, accuracy and consistency are of paramount importance.

Conventional XML-based document automation solutions lack the features necessary to model the broad spectrum of securities used in today’s capital markets.

Designed specifically for financial institutions, WallStreetdocs seeks to overcome these challenges and enable issuers and banks to generate documents for a diverse set of applications. Accordingly, it offers a number of powerful features to facilitate the creation of offering related documents (term sheets, trade confirmations, contracts, prospectuses, prospectus supplements and final terms, notes and closing documents) for a variety of securities, from simple fixed and floating rate bonds to equity-linked notes to complex structured products.

All through 2011 and into 2012 we were rolling out our WallStreetdocs Document Automation product into two of our key clients; Raiffeisen Centrobank where we were engaged to automate the generation of documents for structured notes sold in Austria, Germany and the CEE Region and Bank of America Merrill Lynch in New York where we automated their entire U.S. structured notes business across ten issuers, five asset classes and more than fifty underlings.

How can issuers benefit from WallStreetdocs?

WallStreetdocs allows issuers to achieve substantial efficiency gains by helping them

(1) generate better and more consistent deal documents

(2) substantially reduce transaction costs and

(3) speed up execution.

How exactly does WallStreetdocs work?

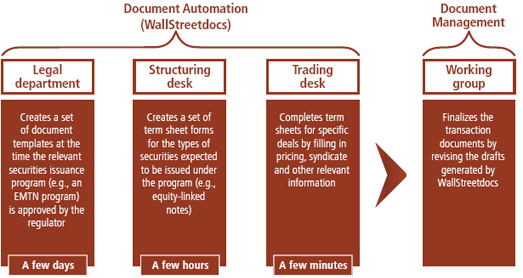

WallStreetdocs enables structurers, traders and lawyers to work seamlessly together.

To facilitate the creation of deal documents, it combines

(1) a flexible user interface for the design of transaction structures modeled on the

layout of real-world term sheets,

(2) an object-oriented component library,

(3) a powerful templating language and

(4) a Microsoft Word plugin that makes template design very easy, even for lay users.

How does WallStreetdocs differ from other document automation systems?

WallStreetdocs is the only document automation solution that has been designed from

the ground up for capital markets transactions. Its uniqueness stems from its focus on

financial instruments, its flexible user interface and its powerful templating language.

These features enable WallStreetdocs to generate documents for deal structures that

are beyond the reach of conventional XML-based document automation platforms.

This revolutionary concept enables WallStreetdocs to generate documents for applications that are beyond the reach of conventional XML-based document automation platforms.